-----------------------------

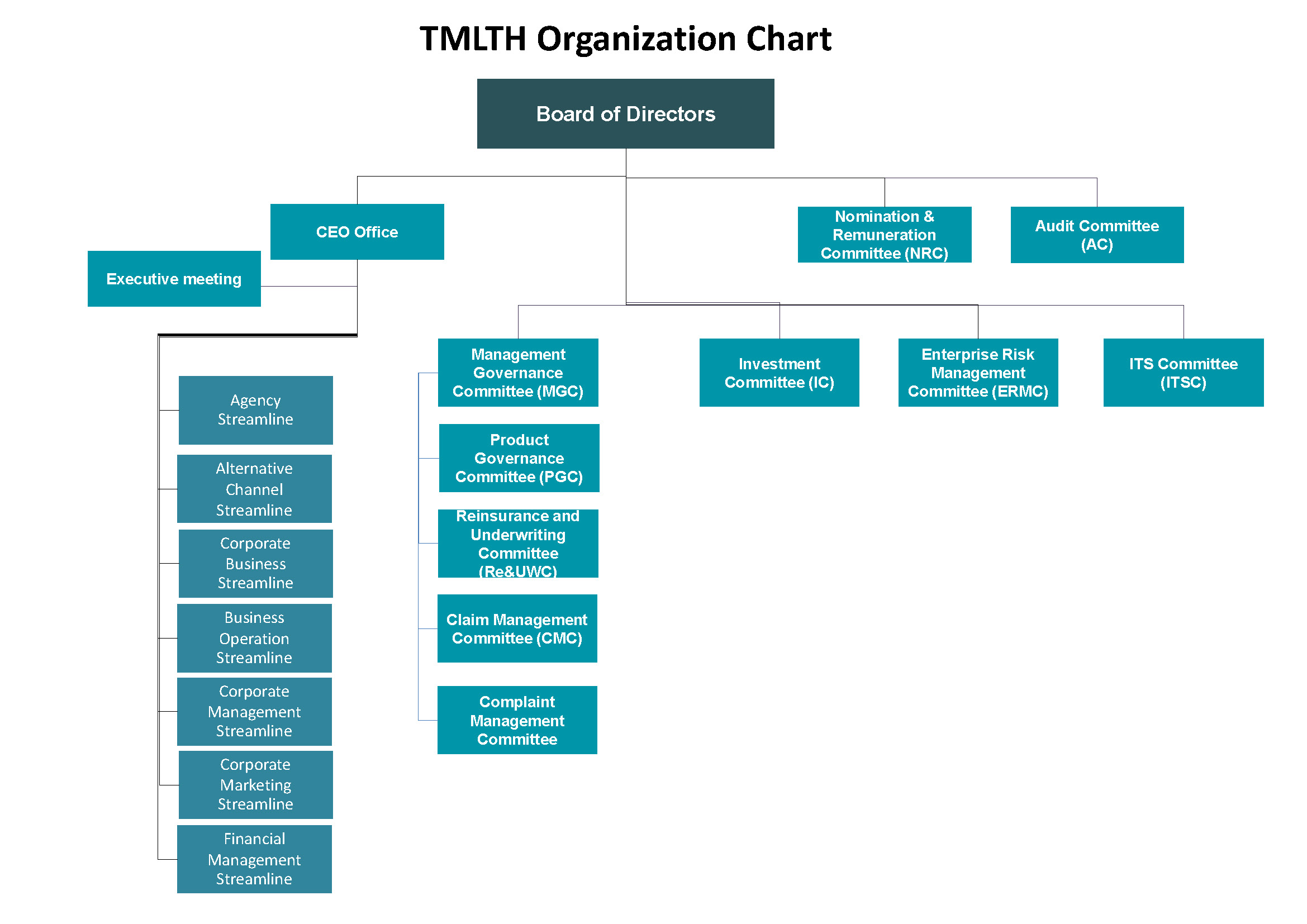

Good Corporate Governance Framework and Internal Control Procedures of the Company

The direction of corporate governance and internal control procedures is to define management frameworks efficiently, transparently, and accountably, while considering all stakeholders, society, and the environment. This is achieved by establishing good organizational structures conducive to effective management through robust internal control procedures, ensuring a proper balance of all functions. The aim is to steer towards the highest benefit for all stakeholders, uphold shareholders' rights, and treat shareholders equally, while respecting the roles of all stakeholders. Crucial information should be disclosed accurately, correctly, and punctually, with distinct roles and responsibilities of directors and management.

Mr. Boonmee Ngotngamwong

Director/ Chairman of the Board of Directors/ Chairman of the Audit Committee / Chairman of the Nomination and Remuneration Committee

Mr. Takashi Saito

In 2023 Mr. Takashi Saito was appointed to replace Mr. Toyotake Kuwata

Director/ Managing Director/ Chief Executive Officer/ Member of the Investment Committee

Mrs. Phusadiporn Tangtrongchitr

Director/ Member of the Audit Committee / Member of the Nomination and Remuneration Committee

Mr. Koompol Buasawan

Director/ Member of the Audit Committee

Mr. Supasak Chirasavinuprapand

Director

Mr. Shinya Nikkawa

Director/ Member of the Audit Committee

Mr. Yoshinari Endo

Director and Member of Nomination and Remuneration Committee

Data as of 11 April 2025

- In 2023, Mr. Tomoya Kittaka was appointed to replace Mr. Yasuhiro Fujita.

- On 2 May 2024, Mr. Yoshinori Endo is appointed to replace Mr. Tomoya Kittaka. And Mr. Shigeru Taguchi is appointed to replace Ms. Ong Hwee Keng (Carole Ong).

- On 4 September 2024, Mr. Shinya Nikkawa is appointed to replace Mr. Shigeru Taguchi.

- On 11 April 2025, Mrs. Phusadiporn Tangtrongchitr is appointed to replace Ms. Sumittra Vorakulchalerm.

Mr. Takashi Saito

In 2023 Mr. Takashi Saito was appointed to replace Mr. Toyotake Kuwata

Chief Executive Officer

Dr. Somphot Keitkraival

Senior Executive Consultant – Office of Management and Agency Streamline

Mr. Sittichai Uytrakool

Senior Executive Vice President - Corporate Business Streamline

Ms. Yuwadee Chalermsripinyorach

Executive Vice President - Financial Management Streamline

Dr. Chatchai Yachantha

Executive Vice President - Business Operation Streamline

Chairman of the Audit Committee

Mr. Boonmee Ngotngamwong

Member of the Audit Committee

Mrs. Phusadiporn Tangtrongchitr

Mr. Koompol Buasawan

Mr. Shinya Nikkawa

Update: 11th April 2025

- On 4th September 2024, Mr. Shinya Nikkawa is appointed to replace Mr. Shigeru Taguchi.

- On 11th April 2025, Mrs. Phusadiporn Tangtrongchitr is appointed to replace Ms. Sumittra Vorakulchalerm

Chairman of the Enterprise Risk Management Committee

- Mr. Takashi Saito

Enterprise Risk Management Committee

- Mr. Sittichai Uytrakool

- Ms. Yuwadee Chalermsripinyorach

- Ms. Saitharn Maneemuang

- Mr. Suthichai Suwanarat

- Ms. Pansupanut Wilaithumrongkul

- Ms. Phakarat Muangyunnan

- Ms. Chinnapak Tordamrong

- Mr. Seung Hwan Chang

- Mr. Phong Nivespathomwat

- Ms. Darawan Phrutnimit

- Ms. Jitra Nakthong

- Mr. Sompong Chungchatraporn

- Dr. Chatchai Yachantha

Chairman of the Investment Committee

Ms. Yuwadee Chalermsripinyorach

Member of the Investment Committee

Mr. Takashi Saito

Mr. Taketsugu Suzuki

Mr. Seung Hwan Chang

Ms. Chinnapak Tordamrong

Mr. Kamolson Anuwutnavin

Update March 22 , 2024

On March 22, 2024, the company changed its directors and the Chairman of the Investment Committee.

Chairman of the Nomination and Remuneration Committee

Mr. Boonmee Ngotngamwong

Member of the Nomination and Remuneration Committee

Mrs. Phusadiporn Tangtrongchitr

Mr. Yoshinari Endo

Update: 11th April 2025

- On 11th April 2025, Mr. Boonmee Ngotngamwong is appointed as the Chairman of the Nomination and Remuneration Committee, replacing Ms. Sumittra Vorakulchalerm and Mrs. Phusadiporn Tangtrongchitr is appointed as the Member of the Nomination and Remuneration Committee.

Scope of Authority, Duty, and Responsibility

1. Establish vision, policy, strategy, business targets, and direction. Supervise and control the management to execute as defined.

2. Establish structure and procedures to align with the rules, regulations, and resolutions of the committee and/or shareholders, including business ethics.

3. Establish structure and procedures for proper risk management, compliance, audit, and internal control.

4. Establish structure and procedures for maintaining risk-based capital at a stable level, sufficient for business operations, and managing risks.

5. Follow up and evaluate management to ensure the achievement of strategies within the budget approved by the Board of Directors.

6. Establish guidelines for evaluating the performance of top management.

7. Establish guidelines for accounting practices and the maintenance of accounting and related documents, ensuring the proper disclosure of information.

8. Oversee to ensure compliance with the submission procedure of external audit reports and management opinions to the Board of Directors as required by law.

9. Oversee and execute to ensure the executives follow ethical guidelines.

10. Formulate a good corporate governance policy, a policy related to social responsibility, and a policy addressing anti-corruption and bribery.

11. Disclose information concerning conflicts of interest or related activities.

12. Propose and seek approval from shareholders for significant activities as defined by the Group Company.

Scope of Authority, Duty, and Responsibility

1. Review financial reporting accurately and thoroughly.

2. Establish an internal control system and an effective internal auditing system. Consider the independence of the internal audit department, including agreeing to decisions regarding appointment, rotation, and termination of the Head of Internal Audit or any other departments responsible for internal audit.

3. Review the company’s compliance with securities and exchange laws, regulations of the Stock Exchange of Thailand, and other laws related to the company's business.

4. Consider, select, and propose the appointment of individuals with independence to serve as auditors for the company, and propose their compensation. Additionally, attend meetings with auditors without the involvement of management at least once a year.

5. Consider related parties transactions or transactions with the possibility of conflicts of interest to ensure compliance with the laws and regulations of the Stock Exchange of Thailand. Verify that such transactions are reasonable and serve the highest benefit of the company.

6. Regularly report the results of internal control and internal audit to the Board of Directors on an annual basis.

Scope of Authority, Duty, and Responsibility

1. Formulate a risk management policy that includes at least the risks stipulated by law and propose it to the Board of Directors for approval.

2. Establish a risk management strategy aligned with the policy, and assess and monitor the risks to ensure they remain at an acceptable level.

3. Assess the sufficiency of the risk management strategy, including the efficiency of the company’s risk management.

4. Report the company’s risk management to the Committee on a quarterly basis to seek advice on updates to ensure proper alignment with the policy and strategy.

5. Define the objectives, authority, and responsibilities of the risk management department.

6. Formulate a policy and guidelines for business continuity and a plan to propose to the Board of Directors for approval. The plan will detail each execution step and will cover at least the steps outlined in the BCM and BCP as stipulated by law.

7. Consult with or conduct a meeting with the Audit Committee as requested by the Audit Committee.

8. Report the results of risk management to the Board of Directors on an annual basis.

9. Handle other matters as assigned by the Board of Directors.

Scope of Authority, Duty, and Responsibility

1. Formulate an investment policy, an enterprise risk management policy, and appropriate investment-related risk management procedures.

2. Consider and approve investment plans.

3. Monitor investment performance and implement an appropriate internal control system.

4. Oversee the company’s investments and investment guidelines.

5. Oversee governance, transparency, and the prevention of conflicts of interest.

6. Report investment performance to the Committee on regular basis.

Scope, Authority, Duty, and Responsibility

1. Consider, nominate, and select qualified individuals for the Board of Directors and Committees to propose to the Board of Directors and/or for approval at the Shareholders meeting, in accordance with the company’s articles of association, as applicable.

2. Consider, nominate, and select qualified individuals for top management positions to propose to the Board of Directors for approval.

3. Consider defining and revising the remuneration and other incentives for the Board of Directors and top management, and propose them for approval by the Board of Directors and/or for approval at the Shareholders meeting, as applicable, in accordance with the company’s articles of association.

4. Perform other tasks as assigned by the Board of Directors.

The company provides an opportunity for shareholders to nominate individuals for consideration and election as directors, including nominations by major shareholders. However, nominated individuals must possess proper qualifications in accordance with the laws and regulations governing the company, including the Public Limited Companies Act, the Life Insurance Act, the Articles of Association, and the Charters of the Board of Directors. The appointment of the company’s top management follows the same procedures.

The company places significant importance on diverse and essential skills, professions, and experiences that greatly contribute to the company’s business across various areas, including business/management, directly and indirectly related businesses, strategic planning, legal matters, accounting/auditing, financial/investment management, international business, and information technology. When considering executives, the scope of their assigned work and the same factors as those used in the nomination of directors will be applied, without limitations or distinctions based on gender, race, or any other differences, all for the highest benefit of the company.

For the reappointment of directors for another service term, the company will consider performance, including beneficial suggestions and opinions provided during the current service term.

In the event of appointing independent directors, the company places significant importance on the independence of such individuals, nominated as independent directors in accordance with the regulations of the Office of Insurance Commission and the company's definition of independent directors.

The Nomination and Remuneration Committee has a duty to consider the remuneration payment method and rate, and propose them to the Boards of Directors for approval, and subsequently for further approval at the Shareholders meeting. This consideration shall be made in accordance with their duty, responsibilities, dedication, the type and size of the business, market conditions, and competitors, ensuring that the proper level of remuneration is set to attract and retain quality directors.

At present, the company has set the director’s fee on a quarterly basis, where the fee reflects the duty and scope of responsibility, aiming to attract directors to perform their duties by regularly attending meetings.

The company considers the remuneration of the Board of Directors, specifically external directors who are not employees of the Tokio Marine Group.

The company considers executive compensation based on the scope of duty and responsibility, as well as performance against targets, including both individual and company targets. Compensation may be provided in the form of salary, bonuses, and other incentives.

Choose your country or region

Visit HQ Pages

Visit Country Pages

Select your location and language

-

All

-

All

-

Asia Pacific

-

Australia

-

Americas

-

Europe

Singapore

Malaysia

Australia

You are currently on a site outside of your country Switch to external site?

Visit your local page. If you change your mind, you can use the dropdown at the top navigation to visit other Tokio Marine country pages.

You are currently on a site outside of your country. Switch to local site?

Visit your local page. If you change your mind, you can use the dropdown at the top navigation to visit other Tokio Marine country pages.